Natural Gas Demand

Natural gas is believed by many to be the most important energy source for the future. The abundance of natural gas coupled with its environmental soundness and multiple applications across all sectors, means that natural gas will continue to play an increasingly important role in meeting demand for energy in the United States. This section will address factors that affect demand for natural gas in the United States, including those trends that are expected to steadily increase demand for natural gas for the foreseeable future, and the long term and short term factors that affect the demand for natural gas. Click on the links below to view:

- Factors Affecting Short Term Demand for Natural Gas

- Factors Affecting Long Term Demand for Natural Gas

|

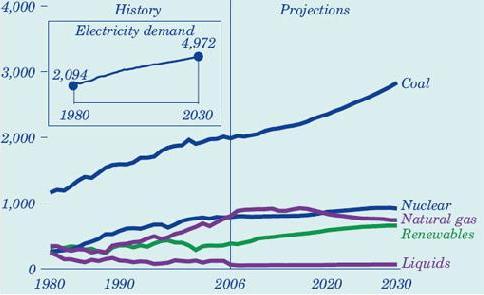

| Energy Consumption by Fuel 1980 – 2030 (Quadrillion Btu) |

| Source: EIA – Annual Energy Outlook 2009 with Projections to 2030 |

The Energy Information Administration, in its Annual Energy Outlook 2011, projects that natural gas demand in the United States could be 26.55 trillion cubic feet (Tcf) by the year 2035. That is an increase of 16 percent over 2009 demand levels. In comparison total energy consumption is expected to increase by 20 percent (from 94.79 quadrillion British thermal units to 114.19) by 2035. The EIA predicts an annual energy demand increase of 0.7 percent over the next 26 years. It is important to note that this steady climb in demand for natural gas could increase as climate change legislation grows demand for low-carbon fuels such as clean natural gas. While forecasts made by different federal agencies may differ in their exact expectations for the increased demand for natural gas, one thing is common across studies: demand for natural gas will continue to increase for the foreseeable future. The analysis of natural gas demand below relies primarily on the forecasts made in EIA’s Annual Energy Outlook 2011.

There are many reasons for the long term expected increase in natural gas demand. As can be seen, demand for all types of energy, except nuclear and hydro power, is expected to increase over the next 20 years. This general upswing can be attributed to the expected general growth of the U.S. economy and population, as well as the increased use of personal technologies such as computers, smart phones and music devices.

Factors Affecting Short Term Demand for Natural Gas

Demand for natural gas has traditionally been highly cyclical. Demand for natural gas depends highly on the time of year, and changes from season to season. In the past, the cyclical nature of natural gas demand has been relatively straightforward: demand was highest during the coldest months of winter and lowest during the warmest months of summer. The main driver for this primary cycle of natural gas demand is the need for residential and commercial heating. As expected, heating requirements are highest during the coldest months and lowest during the warmest months. This has resulted in demand for natural gas spiking in January and February, and dipping during the months of July and August. Base-load storage capacity is designed to meet this cyclical demand: base-load storage withdrawals typically take place in the winter months (to meet increased demand), while storage injection typically takes place in the summer months (to store excess gas in preparation for the next up cycle).

The relatively recent shift towards use of natural gas for the generation of electricity has resulted in an anomaly in this traditional cyclical behavior. While requirements for natural gas heating decrease during the summer months, demand for space cooling increases during this warmer season. Electricity provides the primary source of energy for residential and commercial cooling requirements, leading to an increase in demand for electricity. Because natural gas is used to generate a large portion of electricity in the United States, increased electrical demand often means increased natural gas demand. This results in a smaller spike in natural gas demand during the warmest months of the year. Thus, natural gas demand experiences its most pronounced increase in the coldest months, but as the use of natural gas for the generation of electricity increases, the magnitude of the smaller summer peak in demand for natural gas is expected to become more pronounced.

n general, in addition to this cyclical demand cycle, there are two primary drivers that determine the demand for natural gas in the short term. These include:

- Weather – as mentioned, natural gas demand typically peaks during the coldest months and tapers off during the warmest months, with a slight increase during the summer to meet the demands of electric generators. The weather during any particular season can affect this cyclical demand for natural gas. The colder the weather during the winter, the more pronounced will be the winter peak. Conversely, a warm winter may result in a less noticeable winter peak. An extremely hot winter can result in even greater cooling demands, which in turn can result in increased summer demand for natural gas.

- Fuel Switching – supply and demand in the marketplace determine the short term price for natural gas. However, this can work in reverse as well. The price of natural gas can, for certain consumers, affect its demand. This is particularly true for those consumers who have the capacity to switch the fuel upon which they rely. While most residential and commercial customers rely solely on natural gas to meet many of their energy requirements, some industrial and electric generation consumers have the capacity to switch between fuels. For instance, during a period of extremely high natural gas prices, many electric generators may switch from using natural gas to using cheaper coal, thus decreasing the demand for natural gas.

- U.S. Economy – The state of the U.S. economy in general can have a considerable effect on the demand for natural gas in the short term, particularly for industrial consumers. When the economy is expanding, output from industrial sectors is generally increasing at a similar rate. When the economy is in recession, output from industrial sectors drops. These fluctuations in industrial output accompanying economic upswings and downturns affects the amount of natural gas needed by these industrial users. For instance, during the economic downturn of 2008, industrial natural gas consumption fell by over 7 percent. Thus the short term status of the economy has an effect on the amount of natural gas consumed in the United States.

Factors Affecting Long Term Demand for Natural Gas

While short term factors can significantly affect the demand for natural gas, it is the long term demand factors that reflect the basic trends for natural gas use into the future. In order to analyze those factors that affect the long term demand for natural gas, it is most beneficial to examine natural gas demand by sector. However, it is useful to have an understanding of what natural gas is used for in each of these sectors beforehand.

The analysis of factors that affect long term demand across all sectors are complicated. The actual demand for any source of energy relies on a variety of interrelated factors, and it is very difficult to predict how these factors will combine to shape overall demand. To learn more about the prospects for natural gas and energy demand in the long term, visit EIA.

Click on the links below to be transported directly to demand analysis for each sector:

- Residential and Commercial Demand

- Industrial Demand

- Electric Generation Demand

- Transportation Sector Demand

Residential and Commercial Demand

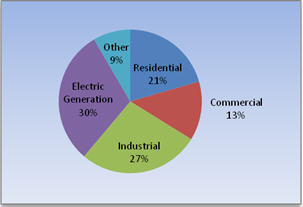

The EIA expects residential energy demand to increase 6 percent between 2009 and 2035. Residential use of natural gas is expected to remain flat during that period. Residential natural gas consumption accounts for 21 percent of all consumption in the U.S.

Probably the most important long term driver of natural gas demand in the residential sector is future residential heating applications. Between 1991 and 1999, 66 percent of new homes, and 57 percent of multifamily buildings constructed used natural gas heating. In 2010, 54 percent of new single family homes constructed used natural gas. While these new homes being built are generally increasing in size, the increasing efficiency of natural gas furnaces used to heat them compensates for the increased square footage to be heated. In general, however, the increase in the number of new homes using natural gas for heat over the next 20 years is expected to provide a strong driver for residential natural gas demand.

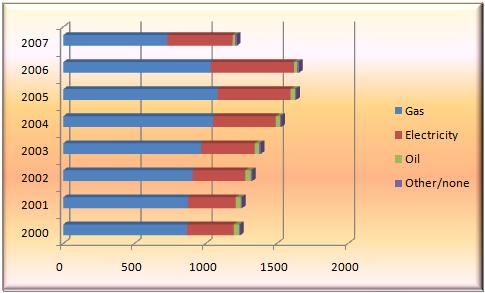

|

| New Houses by Heating Fuel Type 2000 – 2007 (Click Image to Expand) |

| Source: EIA – U.S. Natural Gas Markets: Mid-Term Prospects for Natural Gas Supply – 2008 |

The EIA expects energy demand in the commercial sector to increase at an average annual rate of 1.1 percent through 2035. Commercial floor space is expected to increase at a rate of 1.2 percent per year over the same period, so the energy demand per area of commercial floor space is actually expected to decrease 0.1 percent per year reflecting improvements in energy efficiency. Natural gas currently supplies 15 percent of the energy consumed in the commercial sector and will do so through 2035.

Several other factors are expected to drive residential and commercial natural gas demand, according to a report published by Washington Policy Analysis Inc. (WPA) entitled Fueling the Future: Natural Gas and New Technologies for a Cleaner 21st Century. As the uses for natural gas in the commercial sector are quite similar to residential uses, their expected demand drivers are also expected to be similar. These drivers include:

- Electric Industry Restructuring – as electricity offers the greatest competition to natural gas use in the residential and commercial sector, the availability and price of electricity for retail consumers will affect the demand for natural gas. As the electric industry is restructured and deregulated, it is expected that electricity prices will remain stable or decline slightly over the next 20 years. However, it is expected that those states with low current electricity prices may see rate increases with the introduction of competition. In these states, residential alternatives to electricity, including natural gas appliances and distributed generation, are expected to become more attractive, which will increase the demand for natural gas in these states. In those areas where electricity prices decrease, however, residential natural gas demand may decline slightly, as lower priced electricity offers comparative value. However, the entrance of distributed generation technologies may offset the more competitive prices of electricity, particularly for the commercial sector.

- Natural Gas Industry Restructuring – The restructuring of the natural gas wholesale and retail markets may affect the residential and commercial demand for natural gas. Most forecasts of residential natural gas prices over the next 20 years, including the EIA’s analysis, show natural gas prices increasing slightly over this time frame (due to factors other than increased marketplace competition). However, the deregulation of the natural gas market, and the resulting competition in the industry for retail customers, may in fact reduce natural gas prices over the long term. It is also predicted that natural gas prices for electric generation utilities may increase faster than for residential and commercial consumers – which may drive retail electricity prices higher, and serve to make natural gas (particularly for distributed generation) more desirable for residential consumers.

- Demographics and Population Centers – The changing demographics of the U.S. population also affects the demand for natural gas. Most significantly, according to WPA, recent demographic trends have seen an increased population movement to the Southern and Western states. As these areas are generally warmer climates, there will be an increase in demand for cooling, and less of a demand for heating. As electricity currently supplies most of the nation’s space cooling energy requirements, and natural gas supplies most of the energy used for space heating, population movement may decrease natural gas demand in these sectors. However, as distributed generation and residential natural gas cooling technologies advance, and residential consumers can use natural gas to supply their electricity needs, natural gas demand could in fact increase. Another demographic trend is the aging of the large ‘baby boomer’ generation. It is expected that as this generation ages, their requirements for cooling in warm weather and heating in cooler weather will increase, thus driving demand for both electricity and natural gas.

- Energy Efficiency Regulations – The concept of energy efficiency is continually being addressed in government, by environmental concerns, and by consumer advocacy groups. While the basic advantages to investing in energy efficient appliances are well known in both residential and commercial settings, current regulations do not take into account total energy efficiency (TEE) measured directly from the source. Natural gas is extremely efficient, losing very little of its energy value as it reaches its point of end use. Electricity, on the other hand, measured from the point of generation to the wall socket, is much less efficient. In fact, only about 27 percent of the energy put into generating electricity is available by the time it reaches your home. Thus, while an electric appliance may be extremely efficient in using the electricity it takes from the wall socket, this does not take into account the energy that is lost in generation and transmission. Increasingly strict regulations regarding total energy efficiency may thus make natural gas the more desirable efficient energy source for residential and commercial appliances. For more information on energy efficiency in the United States, visit the American Council for an Energy-Efficient Economy.

- Technological Advancements – Currently, the majority of energy used by the commercial sector is in the form of electricity. Similarly, many common household appliances can only run on electricity. The advancement of natural gas technology in the form of offering natural gas powered applications that may compete with these electric operated appliances may provide a huge increase in demand for natural gas. Natural gas cooling, combined heat and power, and distributed generation are expected to make inroads into those applications that have traditionally been served solely by electricity.

Industrial Demand

The EIA projects that industrial energy demand will increase at an average rate of 0.9 percent per year to 2035. This may seem like a low level of growth, however it represents energy requirements for both energy-intensive manufacturing industries (which are expected to decline), and non energy-intensive manufacturing industries (which are expected to grow). Industrial demand accounts for 27 percent of natural gas demand.

|

| Natural Gas Consumption by End Use 2010 |

| Source: EIA |

The primary force shaping the demand for natural gas in the industrial sector is the movement away from energy-intensive manufacturing processes. There are two driving forces behind this shift: the increased energy efficiency of equipment and processes used in the industrial sector, as well as a shift to the manufacture of goods that require less energy input. This trend is expected to hold into the future, and is the reason for modest increases in energy demand for the industrial sector.

Despite this shift from energy-intensive processes to less energy-intensive processes, the demand for energy is expected to increase in the industrial sector. According to WPA, there are several factors which could affect the demand for natural gas over other sources of energy to meet the long term energy requirements of the industrial sector. These include:

- Economics of the Industrial Sector – The industrial sector has been experiencing a period of consolidation that is expected to last into the future. Industrial companies have been merging at a relatively fast pace; a market scenario in which cutting costs and increasing efficiency becomes paramount. This could lead to increased demand for efficient natural gas powered applications in the sector to replace those processes which are extremely energy inefficient. An example of this is the popularity of natural gas in the generation of steam. Natural gas fired combined heat and power systems, as well as natural gas fired boilers, can be much more efficient and cost effective than older boilers running on coal and petroleum. This is especially true if evaluated on a total energy efficiency basis. However, the replacement of this older industrial equipment with newer natural gas fired equipment requires an up-front capital investment, which may be prohibitive in some situations.

- Electricity Restructuring – The price and availability of electricity in the industrial sector will play a role in determining the demand for natural gas. Many electric generation utilities have been cutting prices for industrial consumers in the hopes of gaining increased market share in preparation for the complete deregulation of the electric industry. However, natural gas powered distributed generation technologies, as well as combined heat and power applications, offer industrial energy users with attractive alternatives to purchased electricity. Some industrial energy consumers, fearful of the effects of deregulation on the reliability and flexibility of electricity supply, may choose instead to generate their own electricity on-site, powered by natural gas.

- Environment Emissions Regulations – It is expected that the restrictions on industrial air emissions will be tightened significantly over the foreseeable future. Government regulators in California and New York have already begun to impose very strict regulations on the harmful emissions of many industrial processes. Natural gas represents a cleaner burning alternative to coal and petroleum use in the industrial sector and the imposition of stringent regulations may serve to increase the demand for natural gas in the industrial sector. Additionally, should an emissions trading market develop (in which, basically, industrial companies are allowed a certain level of emissions ‘credits’, which may be sold if they emit fewer harmful products than they are allowed), the cost of financing new, clean natural gas equipment may be offset by the revenue that may be brought in through the trading of surplus emissions credits. For more information on industrial emissions regulation, visit the Environmental Protection Agency.

- Technological Advancements – As with the residential and commercial sectors, the advancement of new and existing natural gas technologies will play a role in the demand for natural gas from the industrial sector. Distributed generation offers great promise in the industrial sector. The reliability and flexibility offered by the on-site generation of electricity is particularly important for the industrial sector, where loss of electricity could have disastrous consequences, including spoiled products for a manufacturer dependent on electricity. Thus, the expansion of distributed generation, and combined heat and power units, could be the next frontier for increased natural gas demand in the industrial sector.

Electric Generation Demand

The demand for electricity is predicted by the EIA to increase by an average rate of 1 percent per year through 2035. In order to meet this growing demand, EIA predicts that 223 gigawatts of new electric generation capacity will be needed by 2035. Because of the relatively low capital requirements for building natural gas-fired combined cycle generation plants, as well as the reduction of emissions that can be earned from using natural gas as opposed to other fossil fuels, the EIA expects 60 percent of new electric generation capacity built by 2035 will be natural gas combined-cycle or combustion turbine generation.

|

| Electricity Generation by Fuel (billion killowatthours) (Click Image to Enlarge) |

| Source: EIA – Annual Energy Outlook 2008 with Projections to 2030 |

While natural gas-fired electric generation accounted for 16 percent of all generation in 2002, the EIA predicts it will account for 24 percent of all generation in 2035. In addition to increased demand for natural gas powered central station generation, distributed electricity generation (as discussed for residential, commercial, and industrial sectors) may serve to increase the demand for natural gas for electricity generation purposes in the future.

There are two primary forces at work that serve to increase the demand for natural gas in electric generation. The increased demand for electricity in general, combined with the retirement of old nuclear, petroleum, and coal powered generation plants, leaves a significant requirement for electric generation that is to be filled by natural gas use. Natural gas is expected to fulfill the requirements for electric generation for a variety of reasons, including:

- Flexibility and Capital Investment – Natural gas electric generation plants can range in size from large-scale generation plants down to very small-scale microturbines. Most nuclear and coal fired power plants, however, are limited to larger-scale generation, and must produce larger quantities of electricity in order to be economic. Because the demand for electricity is expected to increase modestly over the next 20 years, many electricity suppliers are wary of making the large capital investments necessary to build a coal or nuclear powered generating facility. Natural gas fired plants, with lower capital investment costs and greater flexibility (including shorter construction and lead times) are much more readily available and practical to add incremental generation capacity as it is required.

- Environmental Concerns – Most generation of electricity in the United States comes from coal, mostly due to its extremely competitive price and domestic abundance. However, burning coal for the generation of electricity is extremely polluting. Natural gas, however, is the cleanest burning fossil fuel, and emits very few pollutants into the atmosphere. As public concern over air quality increases, and more stringent emissions regulations are adopted, natural gas is the primary clean burning, environmentally friendly alternative to coal generation.

- Efficiency – Natural gas powered combined cycle generation units are extremely energy efficient. Modern natural gas fired combined cycle generation units can approach 60 percent efficiency, whereas traditional boiler units are usually only around 34 percent efficient, regardless of fuel source. This means that using natural gas powered combined cycle technology allows for more electricity produced per unit of natural gas used. This can both increase the cost-effectiveness of the generation plant, as well as reduce the plants emissions (because less fuel is being burned).

- Operational Flexibility – Natural gas fired electric generation systems used to meet short term peak electricity demands have the advantage of being very operationally flexible. These natural gas fired generators can be quickly and easily turned on and off, allowing for the timely generation of electricity to meet short term requirements on a moments notice. Neither coal nor nuclear generation plants have the ability to operate in this manner. Offering such flexibility in the generation of peak electricity makes natural gas an extremely attractive option for meeting these electricity requirements.

Transportation Sector Demand

Natural gas use in the transportation sector is still in its infancy, although natural gas powered vehicles present an enormous opportunity for cleaning up the emissions from this sector. Demand from the transportation sector accounts for 3 percent of total U.S. natural gas demand, and most of this demand is for natural gas to fuel the pipeline transportation of hydrocarbons. Natural gas supplies barely a fraction of the total energy used in the transportation sector, and the demand for natural gas to supply natural gas vehicle operation is almost negligible compared to the energy requirements of traditionally fueled vehicles.

The demand for alternative fuel vehicles (including natural gas vehicles) is expected to increase in the foreseeable future primarily due to new legislation and regulation surrounding emissions from the transportation sector. As more stringent emissions standards are adopted, both at the federal and state level, the automotive industry will have no choice but to devote significantly more resources into the development of feasible production line natural gas vehicles; vehicles that are environmentally sound and meet consumer preferences. However, the technology required to do so, including the need for a natural gas refueling infrastructure, are current barriers to the widespread proliferation of natural gas vehicles in the United States.